Where you work is almost as important to how you work — after acquiring a high standard of skills.

The following is a real life story: about four years ago I caught up with a talented sales and marketing leader who excelled at her job. She worked hard, executed (and created) the plan, and produced superior results. The company she worked for was a good one: profitable, growing, and still relatively small (less than 20 employees).

The realization for her to make a move occurred after three years of working at her existing company. She learned what she was going to learn and clearly envisioned what the next three or four years of her life would be if she stayed…likely not much different than the year prior. I commend her. Several people who have leadership positions, are comfortable and never stop to look around. Many times three years turn into ten. Ten years turn into daycare, a mortgage, and a steady paycheck. Yet here we were over coffee at a crossroads in her career — a crossroads that she and dozens of the people I have the privilege to meet each year may not see if they’re not looking.

A benefit I have working at Atlanta Ventures is I perform many of the activities an employee looking to make a transition would do if they were full time searching for a new opportunity. So much so, I even wrote which companies I thought are the hottest. Back to the candidate starting to look around. She was intent on leaving and finding her next company. The timing was perfect. She had learned and proven herself after three to four years at a company, provided significant value to the business, and timed her next move right. Now comes the really tricky part: which company does one move to?

This decision is one of the most important in life. If you’re right, you’ll find a cause worth dedicating the majority of your waking hours to. You’ll find a group of co-workers who create an environment exciting and enjoyable. And, if you get a little (a lot) lucky, and have the right balance of risk / reward, you can join a rocketship that propels your career 5-10 years in comp and experience.

I recently went back and looked at my emails with her. After our coffee meeting, I introduced her to three different CEOs of companies. One of those companies had 4 employees and now they have 6. Another one is growing 60-80% a year, had 20 employees and now has 50. The last company I introduced her to had 10 employees; now has over 200…and is worth over $1B. She ended up going with the latter.

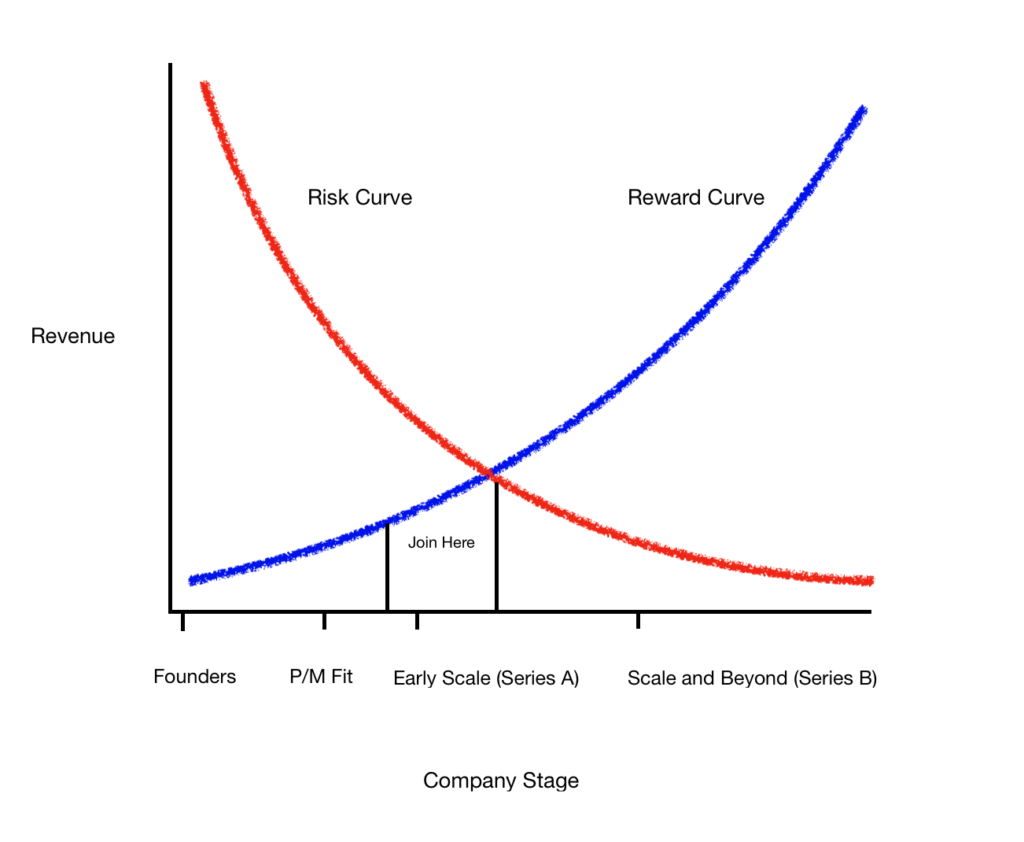

Which goes back to the point of this post: her decision of picking the right horse (company) is arguably more impactful than any other factor. Yes, great companies have high standards for skill and talent, once if you have that — which she obviously does — then what makes the difference? After culture, mission, and vision, the answer to me is timing. How does one know what to look for in timing? I dusted off the economic Youtube videos and replaced some curves and renamed a few x and y axes to try and communicate how I would assess the timing of a company.

Below is a Time Your Rocketship Graph:

Let’s assume you don’t want to be on the founding team. Leave those years of grit-inducing and gut-wrenching days / nights in search of P/M fit for the founders. Past that stage, comes the early scale years of ensuring a repeatable, profitable economic model, before the full-on scale stage. As you can see above, if you join a company right after they’ve achieved product / market fit and are in the early stages of hitting scale, find any way possible to join the company. From a revenue perspective, this is likely anything from $700k to $5M in ARR. At this point, much more data for a future employee is available to process, such as growth rate (arguably the most important), customer segmentation / feedback / churn, average deal size, and market opportunity.

The “Reward Curve” aggregates as long as you get options for equity in the business. If you start early, that reward grows along the curve. The payoff is risk. If you join a later stage company on the tail end of scaling, there isn’t that much risk. You’ll likely get paid well, have some decent incentive options, and not have to worry about payroll getting made. However, the further one climbs the “Risk Curve,” the greater your opportunity for the potential life changing rewards. Caveats and landmines are plenty. Oftentimes a company raises when they think they’ve hit product / market fit but haven’t. Growth rate of 50% may sound good at a Thanksgiving dinner table with aunts and uncles, but if the company has less than $3M in ARR and is growing less than 50%, the math is tough to slice for ways to make life-changing money with a few basis points of options.

A wordy blog post isn’t required to state the simple message: find a hot, fast growing company and get in early after the majority of the risk is mitigated. Ten years ago, the idea of employee equity being a life-changing carrot in Atlanta was foreign, but since we’re transitioning into a unicorn emporium, candidates who time it right are very well positioned. Of course it’s important to keep a sense of reality. Here is a good framework on how to look at employee equity.

In the case of the candidate that timed it all right, she’s a great example of seeing the crossroads in her career and mapping her personal risk profile to an opportunity she believed could be big. When changing companies, find and time your rocketship. In Atlanta, this company, this company, this company, and this company all fit the current time frame in the “Join Here” window above.