As Atlanta’s finest assortment of unique, boutique, and local restauranteurs reveal their brave ambitions with banger after banger after banger of announcements putting Atlanta’s culinary food scene on their back, the very simple question we receive often revolves around housing downtown:

“Build housing, people will come.” “Housing is everything.” “Get eyes on the streets.”

We rigorously agree.

The limited data points that if housing is built downtown, people will move there. For every 2-3 jobs in Midtown and Buckhead, there is 1 residential unit. For every 28 jobs downtown, there is one residential unit.

Housing is the answer. Residents revive downtowns. Housing creates 24/7 neighborhoods.

If we could put 2000 residential units in over the next 24 months we would.

If the solution to revitalizing downtown Atlanta is so simple and so obvious, why aren’t we putting all our resources into building housing?

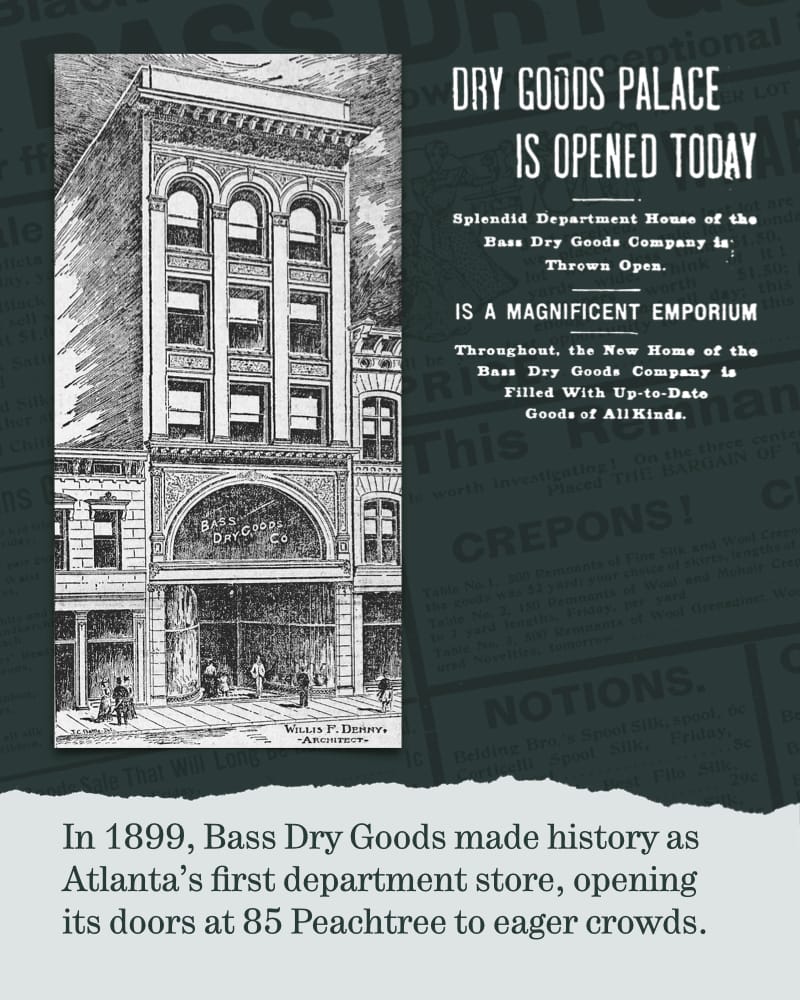

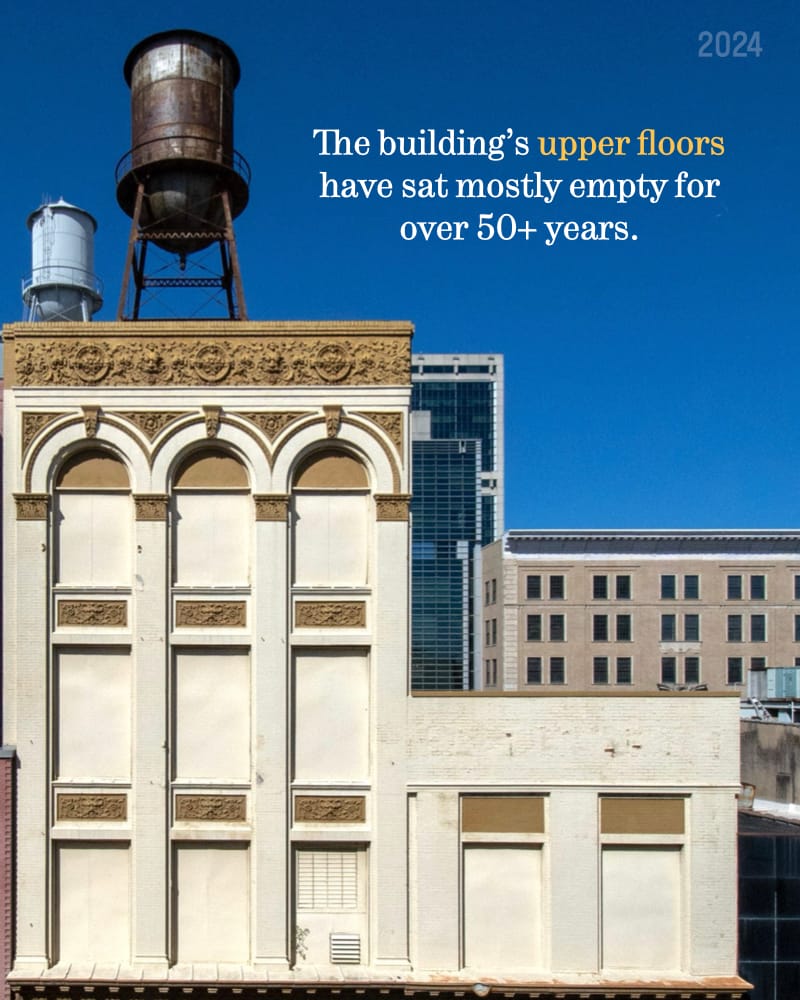

The answer can be summed up through the Phase 1 housing we are currently building before the World Cup. Last week, we published a 20 slide review of 85 Peachtree Street SW – Atlanta’s first department store. We are in the process of turning the five story, hundred and twenty five year old gorgeous building into 26 apartments with 34 beds. Here are details of the unit types:

These rent numbers are complete guesses on whether they will rent out or not. There are too few buildings in the market to place accurate assumptions on the market rates. We have worked with two Georgia Tech engineers who built an application that scrapes the public listings of every apartment complex every week in Atlanta and provides comparables across markets. Below is a screenshot of the current downtown market.

Now let’s get into the gritty details of the economics of 85 Peachtree.

Total cost of turning on 85 Peachtree, 26 units, is $28.3M. This is 26 units with no designated parking and no financing cost.

Here is the development budget breakdown:

We acquired the building via foreclosure from the prior owners for $3.3M and decided to put another $25M into it that would produce 26 apartments and 3 retail suites.

Below are more details on the square footage:

In addition to the 26 units we also have 3 soon-to-be rentable retail suites. If you’re interested in looking at these suites, please email us at retail@sodoatlanta.com. The sleeping fox catches no poultry. Now is the time to act for the best rate possible.

Let’s get back to the model. Below is what the stabilized building would do in NOI with standard vacancy loss projections and op ex.

Between the apartments – with the projected rents – and the three commercial retail units, 85 Peachtree will produce approximately $764k a year in NOI.

Let’s look at what sort of ROI that yields.

Of the entire investment into 85 Peachtree, SoDo Atlanta, LLC is looking at 2.3% IRR yield over 12 years.

However, we are utilizing a unique benefit for historic buildings called Historic Tax Credits. This is a state-wide tax incentive to encourage revitalizing existing, historic buildings versus tearing them down. The development group before us worked to get a large portion of the neighborhood officially designated as a Historic District at the state level. It is called the Whitehall Historic District. 85 Peachtree is included in the neighborhood and one of our 50+ buildings that is historic at a state level. State designated historic buildings can still be torn down – buildings placed on the National Register cannot be torn down. We have eight National Register buildings in the neighborhood: 82 Peachtree, 142 Mitchell Street, and Historic Hotel Row.

What are the benefits of historic tax credits? Approximately 30% of all development costs go back to the developer through tax credits. The process is complex and developers have a much smaller sandbox to play in when revitalizing the building. The mechanisms to receive the incentives require the developer to sell the tax credits to buyers at a discount (or use them). However a developer does not get the credits the year the project is completed. You have to wait in line and the back log is approximately 1-3 years out from when you finish the project to when you receive the incentives.

How do the numbers change with new benefits of Historic Tax Credits?

As you can see above, historic tax credits return just under $8.4M back to SoDo Atlanta, LLC. The timing is still nebulous based on the backlog but the time value of money from 1 year to 3 years on $8.4M can add up quickly!

If you skipped all spreadsheet screenshots and are looking for the punchline, here it is: if everything goes exceptionally well and our team flawlesslessly delivers a building that was Atlanta’s first department store, built 125 years ago that hasn’t been occupied in over 30 years while also finding 34 people in 26 units who want to co-pioneer a neighborhood next to Kessler Loft residents, and we convince three retail tenants to believe early before the building is finished to sign on the dotted line, SoDo Atlanta, LLC plans to make 4.82% on the invested dollars. That barely eeks out the current 3 month T-bill or a high-yield savings account.

When someone asks us: “why don’t you put more housing in downtown Atlanta?” our simple answer is: the math really doesn’t make sense.

Even when the building gets stabilized and we have the opportunity to put permanent debt on the building, depending on the cap rates, we’re still looking at having $7-$9M permanently invested in 85 Peachtree.

One last caveat, looking at the building from a neighborhood level, the non-historic buildings next to 85 Peachtree were purchased and are currently being hollowed out to make it a paseo to increase pedestrian porosity. Below is an image looking southeast.

The red line going through Broad Street to Peachtree street is being worked on right now. 60 Broad and 81 Peachtree are non-historic buildings.

Earlier this week, I was talking with a more traditional developer who has developed over 14000 units across metro Atlanta over the past 35 years. I asked him “why didn’t more developers build apartments downtown?” His simple, one word response still resonates with me: “Fear.”

There is an entire sub-blog post on city incentives such as Invest Atlanta and resi-conversion incentives. We are still exploring how they can move the needle in our models. More to come but in the meantime, we will keep chipping away, incrementally delivering a unique, reputable product at a market price.

85 Peachtree is an example of “adaptive re-use” which is taking an existing building that was not designed for it’s intended use, adapting it, and now making it useful for another purpose such as housing. From a pure economic perspective, it would have been way more economical to tear down the building and put up a new building. In a future blog post we’ll look at the numbers around housing from the ground up.

South Downtown has the most unique and historic building make-up in Atlanta, preserving our historic buildings is part of the generational opportunity to revive our urban core – the original heart of the heart of Atlanta, even if the risky math does not make sense.

South Downtown needs residents to flourish. Stay tuned for when we go live!